Multi-Osc OB/OS Overlap

Product Description

Overview

Many traders use oscillators to trade reversals, but using a single one may result in noise.

A smarter way is to combine multiple oscillators and look for confluence.

Multi-Osc OB/OS Overlap helps you identify reliable OB/OS conditions and provides reversal signals in this way.

How it works

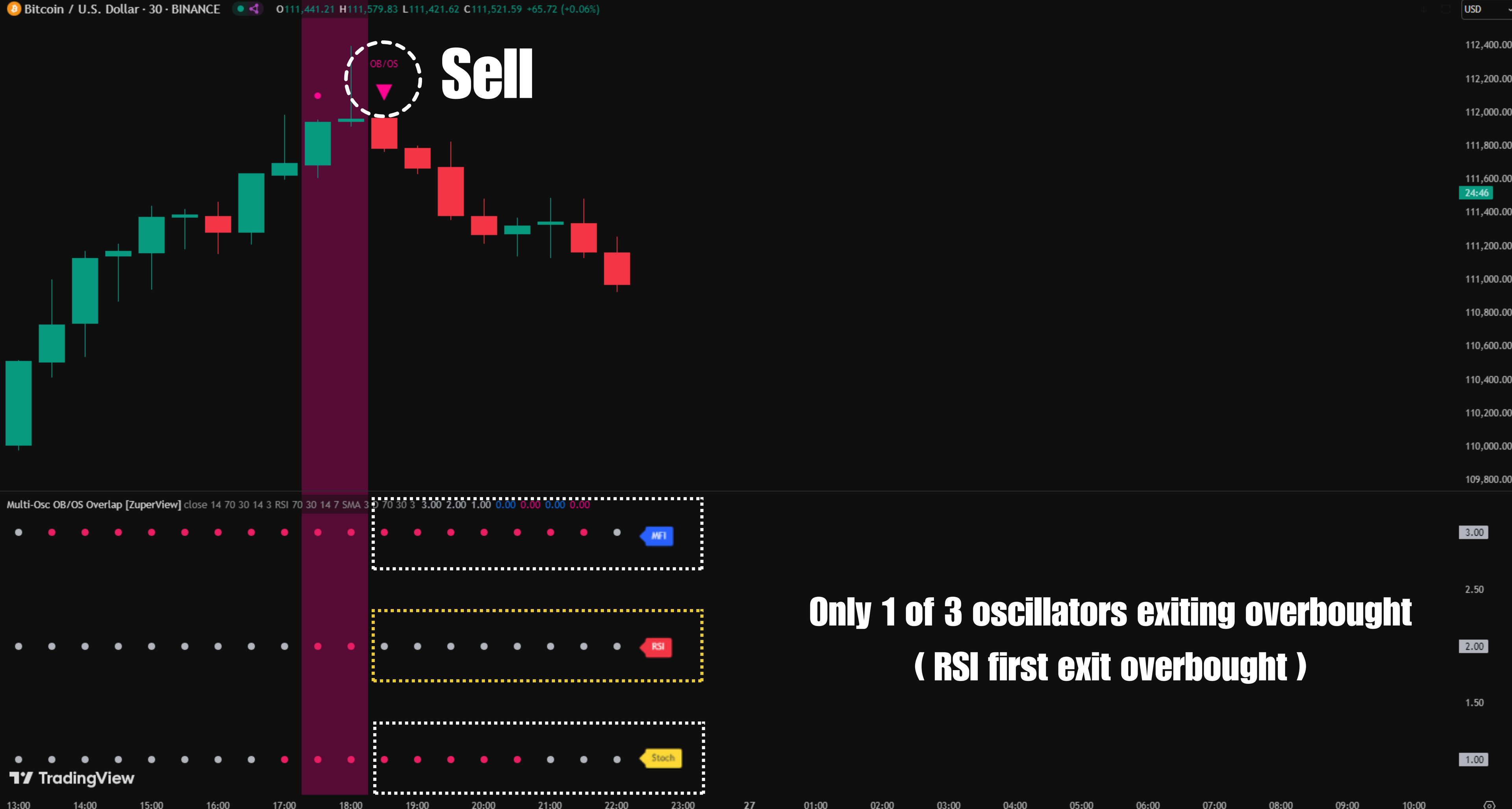

This indicator combines the 3 most used oscillators: MFI, RSI, and Stochastic, and looks for the overlapping signals among them. To be more specific:

- Each oscillator is smoothed to reduce market noise.

- If 3 oscillators agree that price has reached OB/OS conditions, the indicator highlights the overlapped OB/OS zone.

- Overlap at Overbought (OB) → It generates a SELL signal.

- Overlap at Oversold (OS) → It generates a BUY signal.

What it gives you

- More reliable signals through multi-layer confirmation

- Filters out false triggers from single oscillators

- Clean, space-saving design compared to stacking multiple panels

- Fully customizable thresholds for each oscillator

- Signals that align not just with oscillators, but are also confirmed by price action

How to trade with it

For a classic OB/OS trading setup, use default oscillator thresholds of 70/30.

Or try these 2 alternative setups:

1. Catch deeper reversals:

+ Set thresholds to 80/20 for deeper, more extreme reversals.

2. Trade pullbacks with another trend indicator:

+ Set thresholds to 50 (the centerline).

+ Use centerline crosses as pullback opportunities within the main trend.

Make the most of OB/OS conditions and trade your way.

Changelog