Skip to product information

Superior Ichimoku

Sale price

$158

Regular price

$396

Product Description

Overview

Superior Ichimoku refines the traditional Cloud by reducing noise and lag, making signals clearer and faster to interpret.

It highlights trend shifts with improved detection, while cleaner visuals strengthen support and resistance zones. With built-in volatility awareness, it adapts better to stop placement and position sizing.

Key components

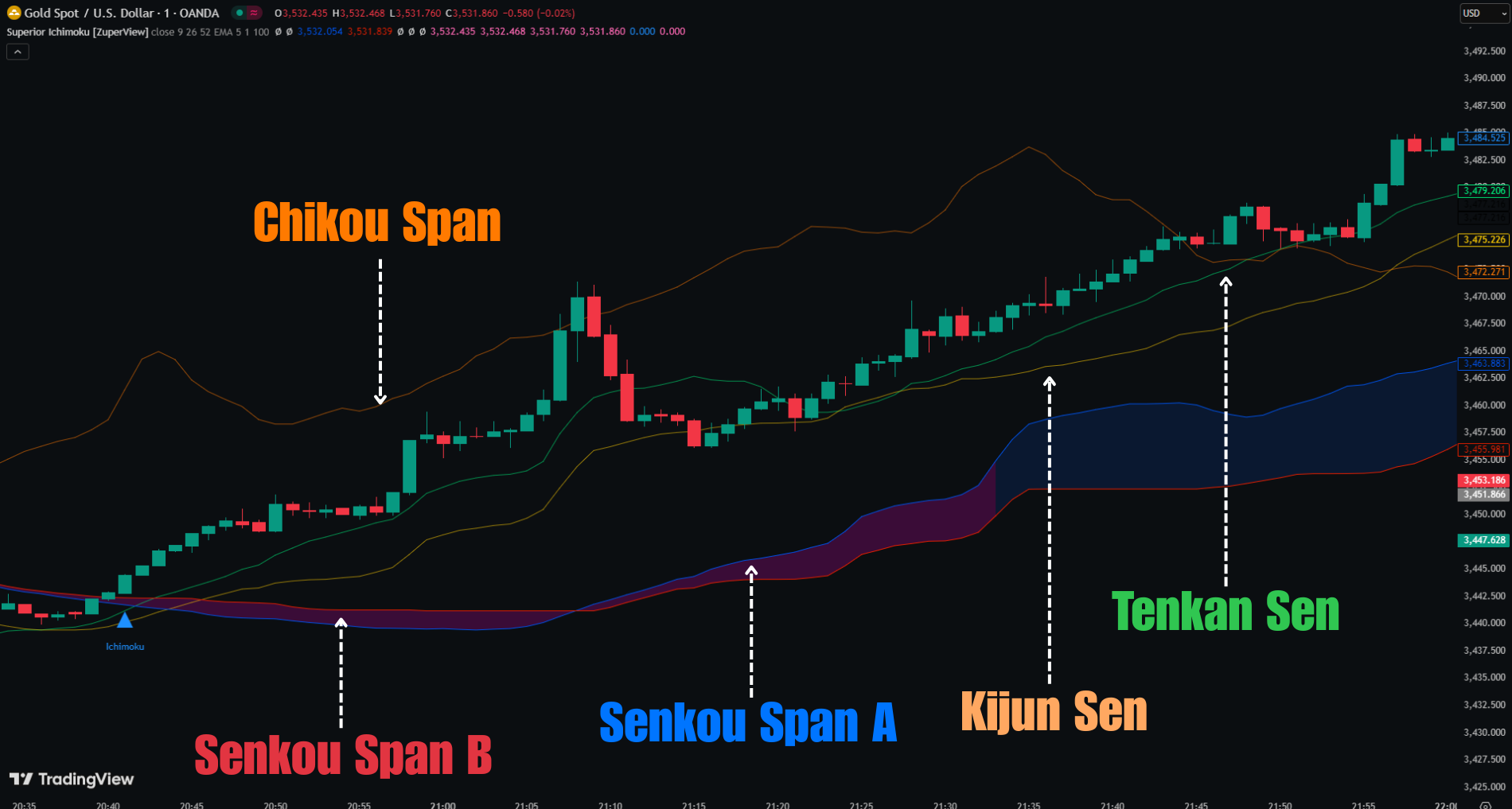

Superior Ichimoku preserves the familiar structure of the original indicator with 5 essential elements:

- Tenkan-sen: Measures short-term trend and reacts quickly to price, similar to a fast moving average.

- Kijun-sen: Tracks medium-term trend and serves as a dynamic support/resistance.

- Senkou Span A: Marks the faster cloud boundary, reflecting near-term price action.

- Senkou Span B: Defines the slower cloud boundary, highlighting longer-term support/resistance.

- Kumo (Cloud): Shades the area between Span A and B, showing prevailing trend and future support/resistance.

- Chikou Span: Validates current price action against past prices.

What makes Superior Ichimoku different

The following refinements make Superior Ichimoku more responsive and trader-friendly than the traditional cloud.

1. Smoothing method

- Standard Ichimoku: Calculates directly from raw prices, with no smoothing options.

-

Superior Ichimoku: Allows price data to be refined with 11 moving averages, producing smoother plots and fewer false signals.

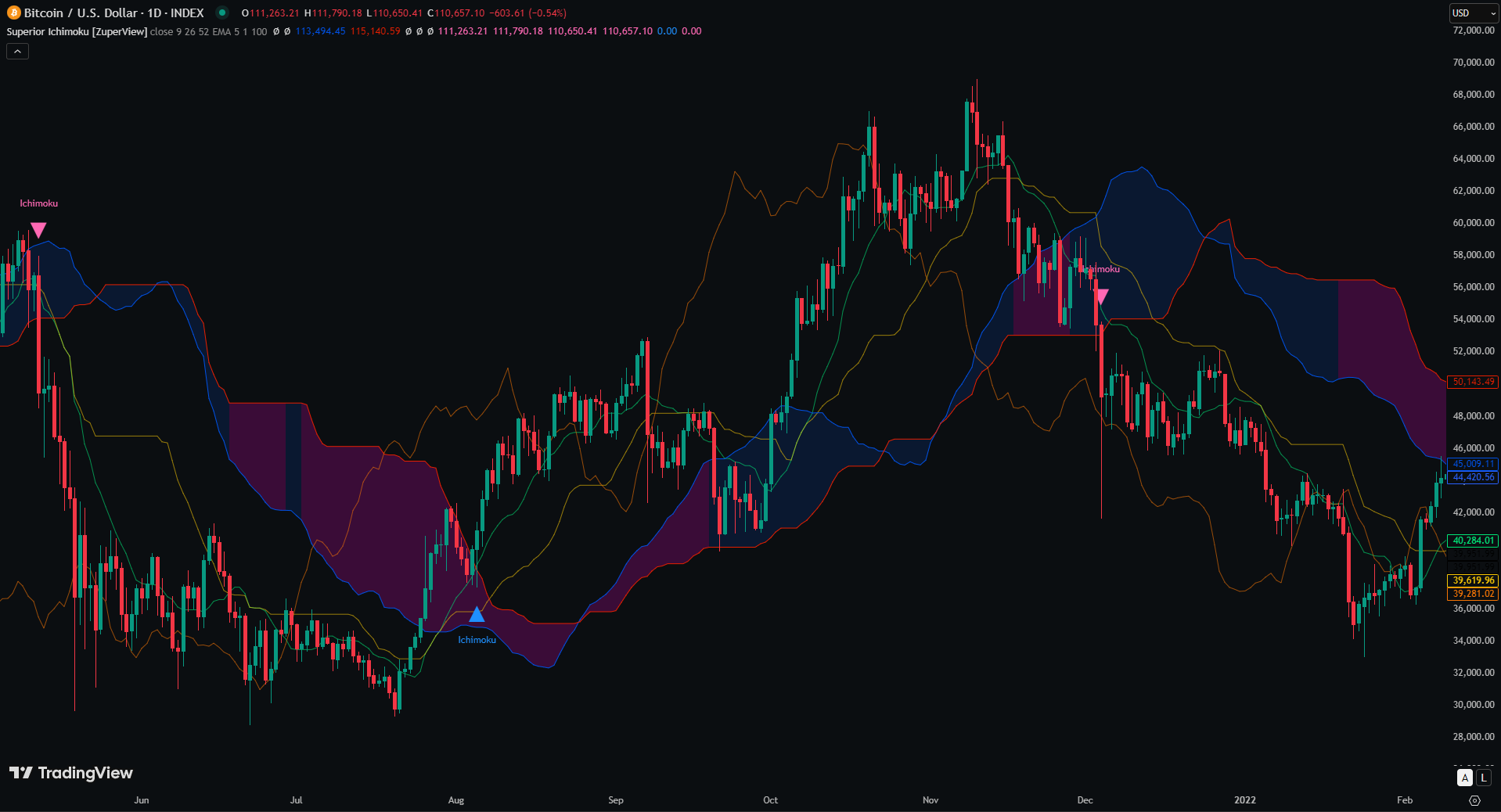

2. Trend phase detection

- Standard Ichimoku: Defines trend purely by price location relative to the cloud (above = up, below = down), making it prone to false flips.

-

Superior Ichimoku: Adds a unique trend state tolerance feature using ninZaATR units. By default, price must break at least 1 ninZaATR beyond the cloud to confirm a new trend.

This filters out fake reversals and improves reliability.

3. Volatility measurement

- Standard Ichimoku: Lacks integration with ATR.

- Superior Ichimoku: Uses ninZaATR instead of the conventional ATR. This enhanced version delivers more stable and precise volatility readings, especially effective on intraday charts.

Changelog

✖