Skip to product information

Divergence Engine$

Sale price

$190

Regular price

$476

Product Description

Overview

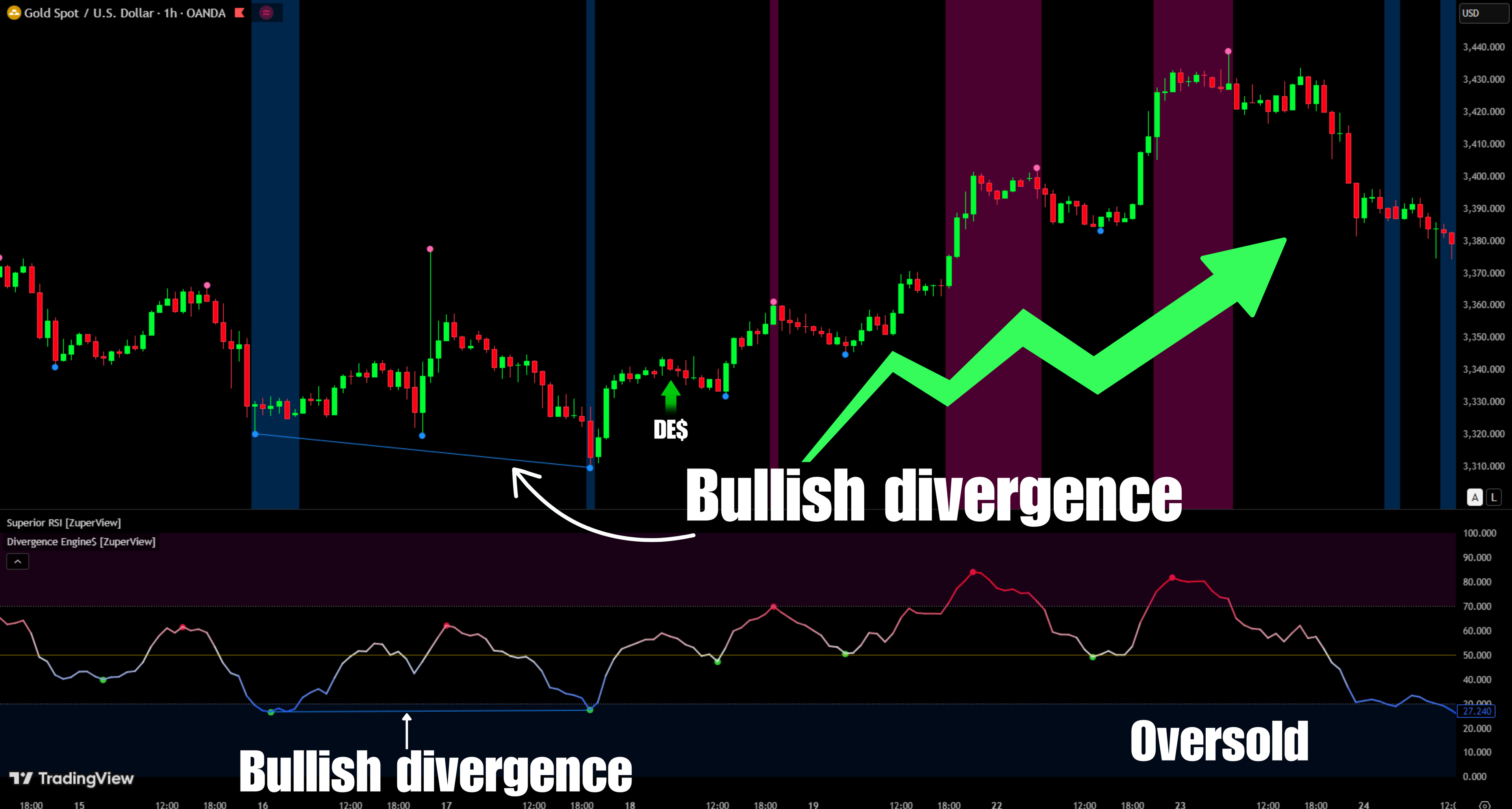

Divergence Engine$ is a flexible, automated divergence indicator for TradingView that gives you more control than standard tools.

It catches regular divergences that signal potential trend reversals, helping you spot key turning points with confidence. You can:

- Use any oscillator – RSI, MACD, Stochastic, CCI, or your own custom choice.

- Adjust swing-point and lookback settings to match your trading style.

How Divergence Engine$ works

-

Step 1: Detect swing points

The indicator scans your chart to identify swing highs and lows.

It waits for a set number of bars (you choose the value) to confirm each swing so the peaks and troughs are accurate.

-

Step 2: Compare price and oscillator

Once a swing is confirmed, the indicator compares price action with the oscillator you select – RSI, MACD, Stochastic, CCI, or any custom input – to look for regular divergence.

-

Step 3: Highlight divergence

When a bullish or bearish divergence is found, Divergence Engine$ draws divergence lines, marks the chart, and highlights the region for easy visibility.

The "Lookback" feature

The Lookback feature controls how many swing points the indicator scans for divergences, giving you the flexibility to filter signals and reduce noise.

- The indicator always compares recent swing highs/lows to detect divergence.

- Lookback lets you set a scan range. For example:

- Min = 3, Max = 5 → scans divergences only within the 3 to 5 most recent swing points.

- You can also set Max = 10 to scan up to the latest 10 swing points.

This gives you the ability to:

- Focus on major swings: In choppy markets, you can tell the indicator to check only larger, more significant swings and skip minor divergences.

- Adjust scan depth:

- Short-term traders can use a smaller range (3–4 swing points).

- Longer-term traders may widen it up to 10 swing points.

- Refine signals: This flexibility supports different strategies – from scalping to swing trading – while filtering out weak setups.

Changelog

✖