PANA Kanal

Product Description

Overview

PANA Kanal is a multifunctional yet practical indicator designed to help you make faster, more accurate, and more confident decisions.

Built with a balance between flexibility and precision, it streamlines your trading process – reducing errors, cutting through noise, and supporting effective trade management.

Key benefits

1. More reliable entry signals

Thanks to its unique signal logic, PANA Kanal reduces false entries.

- The Pullback signal appears only once in each trend, helping you catch the first reliable move.

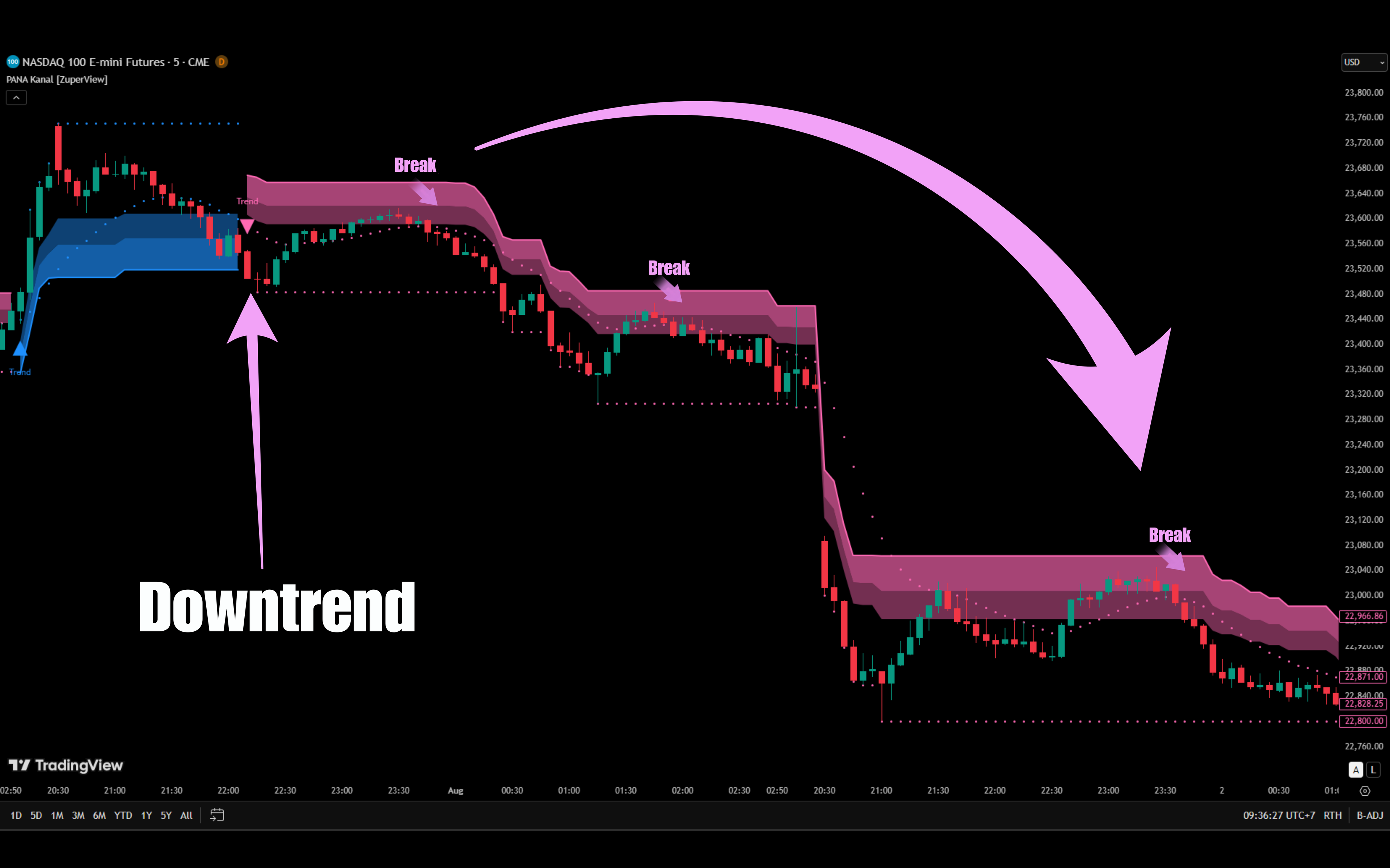

- The Break signal applies two confirmation filters, ensuring you avoid weak or deceptive breakouts. This results in fewer but higher-quality trades – especially valuable for traders who dislike getting caught in whipsaws.

2. Clear and intuitive Trend visualization

The Fibonacci–ATR ribbon makes trend direction and strength instantly visible – no need for manual trendlines or subjective analysis.

You can quickly identify where price stands within the trend, allowing faster and more confident decision-making.

3. Market structure awareness

PANA Kanal reads market structure dynamically, identifying when price breaks highs or lows, loses momentum, or moves sideways. This helps you evaluate true market strength and recognize potential reversals – a crucial layer that many indicators overlook.

4. Adaptable to any trading style

With dynamic support and resistance zones, the indicator reacts in real time to minor price fluctuations.

Scalpers can benefit from frequent and filtered break signals, while swing traders can rely on the early pullback signal for long-term entries.

5. Built-in risk management support

Integrated trailing stop and target markers help you place stops and profit targets with clarity and consistency. This reduces emotional decision-making, promotes discipline, and enhances overall risk control.

How PANA Kanal works

At its core, PANA Kanal calculates a Fibonacci-based range that expands or contracts with ATR volatility.

This creates an adaptive channel that moves with the market – widening during high volatility and tightening during consolidation.

Within this framework, the indicator generates two primary trading signals:

- Pullback signal: Appears once per trend, typically at the start of a new move, helping traders catch early momentum and ride the trend.

- Break signal: Confirmed by 2 filters: the price must first reach the dynamic support/resistance zone, then cross the main plot line. This dual-filter mechanism filters out noise and isolates moments of genuine market strength.

Beyond entries and exits, the indicator also identifies market structure in real time, helping you recognize when:

- The trend is strengthening (breaking new highs or lows).

- Momentum is weakening (failing to surpass the last swing).

- The market is flattening into consolidation.

This layered perspective gives you a clearer sense of market rhythm – empowering you to time entries better, manage trades with confidence, and stay out when conditions are unclear.